Dear Datuk Seri Dr. Mahathir,

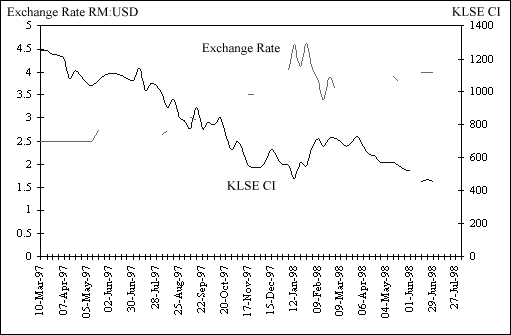

I have tried to build a picture of how the exchange rate has moved over the last few months. Below is the graphical presentation but the curves are broken at places because I did not have the data for these periods. The data may not be exact as I measured it out from the graphs in Lim Kok Wing's book Hidden Agenda, but what is important is the trends.

It looks like its has stabilised at around 4 Ringgit to a US$. I do believe that the public and the financial people need to understand that the currency 'has stabilised' for us to get investor / consumer / bankers confidence back. (There is no one still short selling the currency?) Some form of re-education or marketing needs to be carried out.

I checked with the banks in Singapore and found out that the FD interest rates for Sing dollars is around 5%-6% but for Ringgit deposits it is around 18%. My guess is that we need to understand and take into account that people moved their life savings out in fear of loosing everything they had, over the years, worked hard for. Secondly I believe Singapore had done us a favour by creating a demand for the Ringgit without destabilising their currency. I also understand that Singapore had help Thailand with their Baht. We need to keep friendly neighbours.

I do not know whether this is possible or practical or whether you would want the Ringgit exchange to improve with respect to the US dollar. But both countries, Singapore and Malaysia could gradually buy back the Ringgit to improve the exchange rate by the year end. Singapore also benefits by this as later they could gradually sell off for more US dollars. And the Singapore banks will realise that they have to reduce the Ringgit interest rates as it would be too expensive for they to pay out the 18% interest.

Thirdly, from a layman's point of view, the stocks on the KLSE are at premium value. They will never be cheaper. I believe they are at the lowest in about 8 to 12 years. Investing now and selling off in the coming bull run will enable them to make x3 to x10 return on investment. I believe our market analyst should come out of the wood work and explain this to the public at large.

If you ask me what caused the severity of the crash, my personal opinion was that our bankers were foolishly giving easy overdraft facilities to every Tom, Dick and Harry to throw money at the stock market when it had peaked. Now they do not have the funds to provide overdraft facilities for business to survive, perform and prosper.

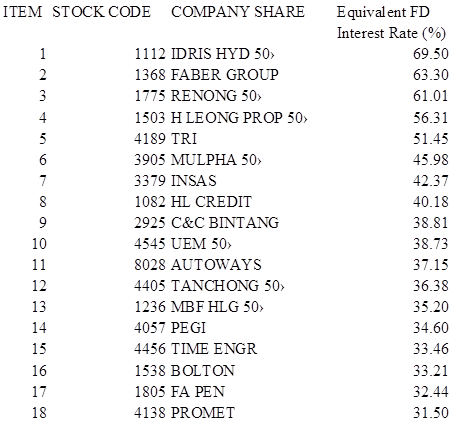

Below is a list of companies that my program had analysed and 'made money' on between 1987 and 1995. The profits are rated in terms of equivalent bank interest rate, as comparative figures. You would realise that investing wisely in the stock markets can bring returns as high as 60% per annum, which makes the bank interest rates look pathetic.

These figures do not include bonus issues, stock splits and dividends paid out. I do hope this information will help win back public confidence in our economy and there by boost the currency.

.....

an engineer

This article on the 5th letter to PM was reproduced here by Dr. Peter Achutha - 24 December 2017.